Planning to avoid financial mistakes

Selling shares when prices have tumbled or buying a house at the height of a property boom only to dispose of it when the market falls are among the financial set-backs that can happen to anyone on the road to retirement.

Everyone makes mistakes during their investment lifetime; the trick is to avoid them when you can and learn from the ones you can’t.

Have a plan

Failing to plan for retirement and build up savings is one of the most common mistakes. Having adequate retirement funds can be undermined by unrealistic expectations about future lifestyle and the savings needed to fund it.

Many retirees are unable to access the age pension because they are asset rich despite being income poor. Putting well thought out investment plans in place to boost your retirement income well before you reach retirement age is the best strategy to overcome such a problem.

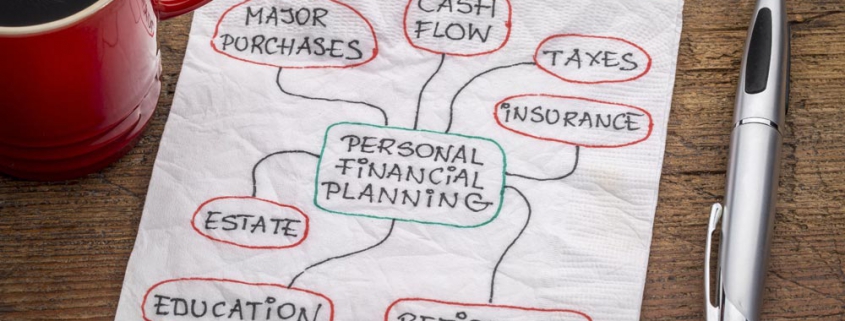

It’s probably no surprise you are more likely to achieve your financial goals if you have a plan. In the construction of a financial plan you should take account of your risk tolerance, your financial commitments and financial and lifestyle goals. This will give you the confidence to know you can get to your desired destination. A comprehensive plan should also take account of tax, cash flow, superannuation, insurance needs and estate planning issues.

Stay calm

Impulsive decision-making at the first sign of trouble can undermine your investment goals. If a quality share investment or rental property suddenly falls in price due to a market correction, it is often not the best time to offload. As one once put it, “Don’t just do something, sit there”.

Staying the course and letting time work its magic will often leave you in a stronger position.

Equally, investment inertia can be problematic. Strong or poor performance can lead to your investment portfolio moving outside your required risk tolerance over time. Regular reviews to rebalance investments back to your target asset allocation will more likely bear fruit in the long term.

Spend less than you earn

Drawing up a budget is vital if you want to discipline yourself to spend less than you earn. Failing to budget makes it difficult to keep track of spending and set aside regular savings to fund a comfortable retirement.

Bank transaction accounts are ideal for daily spending money but not investment money. In order to beat inflation and produce the returns you need to fund your financial goals over time, you need to build a diversified investment portfolio to match your capital requirements.

Spreading money across the major asset classes of cash, fixed interest, shares and property helps minimise risk. It also helps produce consistent returns from a combination of income and capital growth over the long run. The precise combination of assets is dependent on your risk profile. Your adviser should undertake comprehensive research and implement proven portfolio construction principles.

It’s never too late

It’s never too late to start planning for retirement. Paying off the mortgage is often considered the first step to wealth creation so increase repayments where possible to speed up the process. Once you have built up equity in your home other investment options can be investigated concurrently.

Topping up your super through salary sacrifice is one such option, provided you stay within your annual contribution limits. Your employer pays a proportion of your pre-tax salary into your super fund, reducing tax and boosting your savings at the same time.

Review regularly

Financial planning is a dynamic process. Regularly reviewing your investments, refraining from knee-jerk reactions, understanding market volatility and staying the course can lay the foundations for a prosperous retirement.

This editorial contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider you financial situation and needs before making any decisions based on this information.