WHAT HAS HISTORY SHOWN US ABOUT INVESTING?

In view of the recent market ups and downs, if you’re an investor, you might be thinking about pulling out of higher risk investments, such as shares, and transferring them to lower risk investments, like cash or term deposits.

But if you’ve just started your investment journey, you might not be aware of how investments perform over time.

So here are some things to think about before making any changes to your investments.

Markets always recover

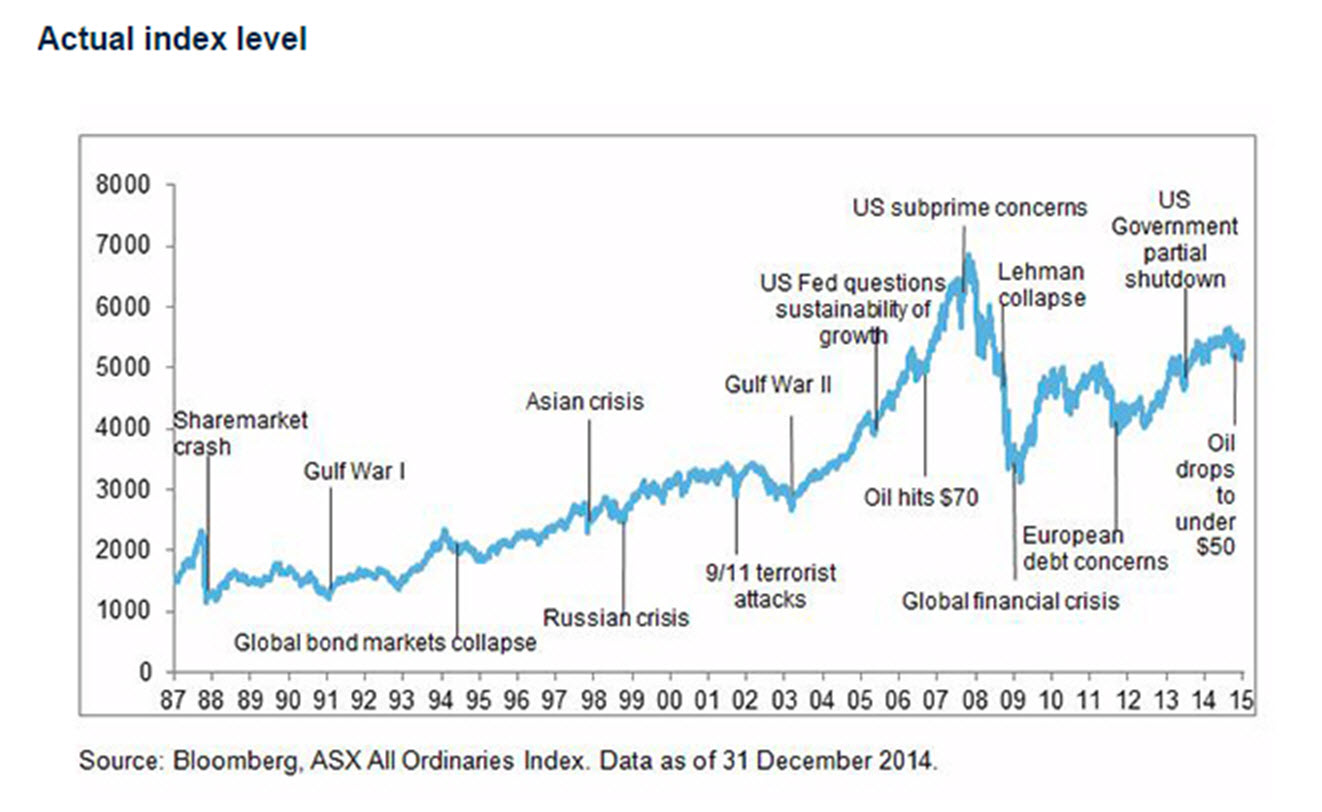

Share markets go up and down and this affects investor sentiment and the performance of listed companies which trade on the official stock exchange. The Global Financial Crisis (2008) had a major impact on the Australian share market but the market recovered. So it’s important to remember that markets always rebound from major events and move on to new highs, as the graph below shows.

Time is on your side

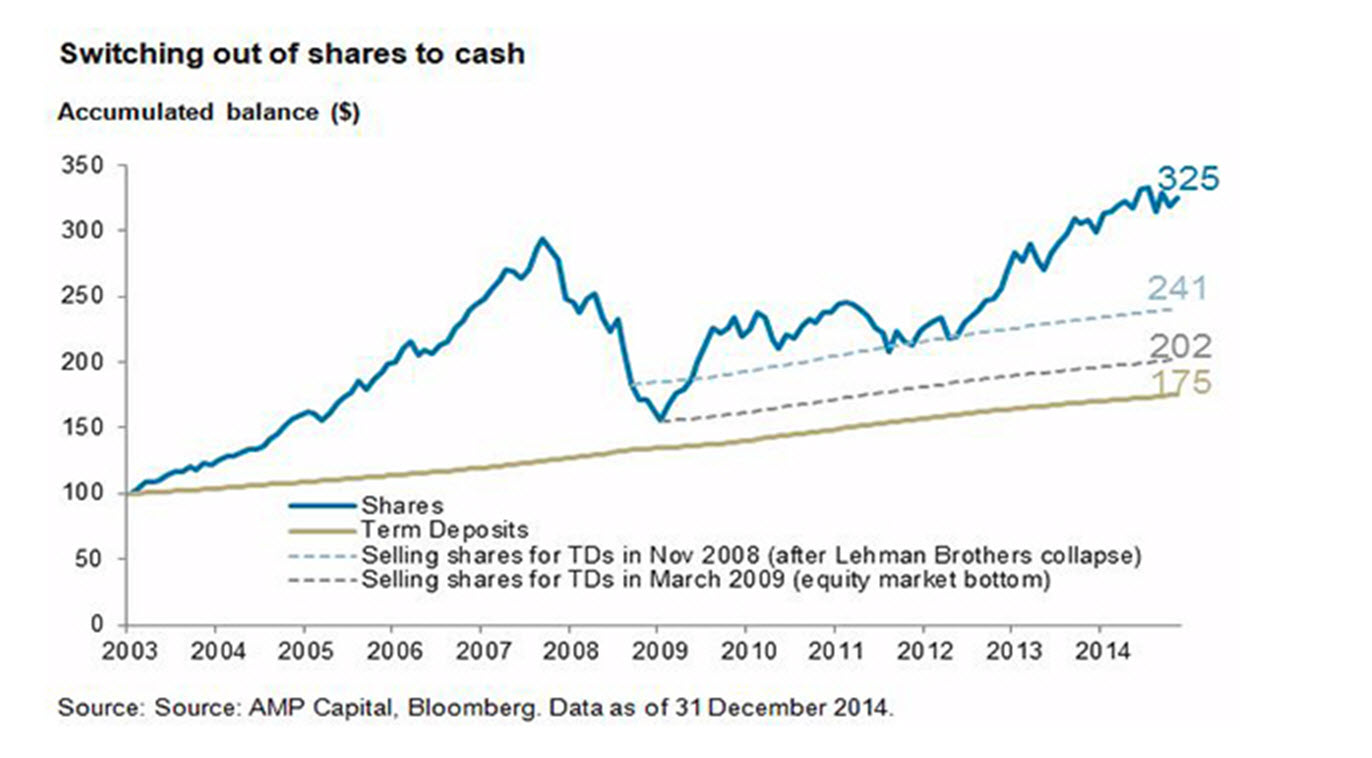

History tells us that investing in shares almost always provides a higher return than investing in low risk investments, such as cash or term deposits.

For example, if you’d had shares and switched out of them into cash during the Global Financial Crisis (GFC) in 2008, you’d still be recovering from their drop in value. But if you were an investor who ‘rode the storm’ and kept your money in shares, you’d be better off now, as you can see from the graph below.

We can’t predict the future

There’s no crystal ball to tell us when the markets are going to change and how they’re going to perform over time. That’s why, generally speaking, it’s best to have a variety of investments across different asset classes.

And remember to take a long-term view when it comes to investing.

Want to know more?

If you’d like to learn more, call us on (03) 9851 0300 so we can help you on your investing journey.